Tuesday, September 12, 2023

Computerized Accounting Courses in Multan

Tuesday, September 5, 2023

Financial Statements

|

| Financial Statements |

Introduction:

Financial statements are official records that pass on a company's financial status and execution. These explanations are reviewed by government bodies, bookkeepers, and businesses to guarantee precision and compliance. For-profit substances show adjust sheets, wage articulations, cash streams, and value changes. Non-profits utilize a comparable, however particular, set of financial statements.

Types of financial statements

1. Balance Sheet.

2. Income Statement.

3. Statement of Cash Flows

1. Balance Sheet

The balance sheet is one of three primary financial statements. These explanations are essential to budgetary modeling and accounting. The adjustment sheet shows a company’s add-up to resources and how these resources are financed through either obligation or value. The adjustment sheet is related to taking after essential conditions.

Assets = Liabilities + Value

Thus, the balance sheet is divided into two sides. The left-hand side of the balance sheet outlines the company’s assets. On the right-hand side, the adjustment sheet outlines the company’s liabilities and equities. On either side, the mainline things are generally classified by liquidity. More liquid accounts, such as inventory, cash, and trade payables, are set before illiquid accounts, such as plant, property, equipment, and long-term debt. Assets and liabilities are also separated by current assets/liabilities and long-term assets/liabilities.

How to set up the balance sheet?

Balance sheets, like all financial statements, will have minor divergence between organizations. Be that as it may, there are a few “buckets” and line things that are nearly continuously included in common adjust sheets. We briefly go through commonly found line things beneath Current Resources, Long-Term Resources, Current Liabilities, Long-Term Liabilities, and Value.

|

| Balance Sheet |

2. Income Statement

The income statement is one of three critical statements, both in financial displaying and accounting. This statement shows the company’s income, costs, net benefit, offering and regulatory costs, other costs, pay, charges paid, and net benefit coherently and consistently. The statement is separated into periods that consistently take after the company’s operations. The most common intermittent division is month-to-month, although certain companies may utilize quarterly divisions or thirteen-month cycles.

How to set up the income statement?

The wage explanation may have minor varieties between diverse companies, as costs and wages will be subordinate to the type of operations or trade conducted. Be that as it may, there are a few non-specific line items that are commonly shown within the income statement.

Sales Income

The company’s income from deals or benefits is shown at the exceptionally beat of the explanation. This value will be net of the costs related to making the products sold, or in giving the benefit.

Cost of Goods Sold (COGS)

This line thing totals the coordinated costs related to accomplishing the income. Settled costs and overhead are prohibited.

Gross Profit

Gross profit is found by subtracting COGS from Deals Income.

SG&A Expenses

The selling, general, and administrative section will contain all other indirect costs associated with running the business. It includes salaries of management, advertising expenses, travel expenses, and sometimes depreciation and amortization, among others. Entities may, in any case, choose to put depreciation and amortization in their section.

EBITDA

While not displayed in all income statements, Earnings before Intrigued, Charge, Deterioration, and Amortization can be found by subtracting SG&A costs (excl. amortization and depreciation) from net benefit.

EBIT

Similarly, while not shown in all wage explanations, Profit before Interest and Tax is found by subtracting devaluation and amortization from EBITDA.

Interest Expense

It is common for companies to part out intrigued cost and interest income as an isolated line thing within the wage explanation. Usually done to be able to accommodate the contrast between EBIT and EBT. Intrigued, the cost is decided through the debt schedule.

EBT or Pretax Income

Profit before charge or pretax income is calculated by subtracting interest expense from EBIT. Typically, the final subtotal is some time recently finding a net salary.

Income Taxes

Income taxes refer to relevant charges to the pre-tax income.

Net Income

After deducting income taxes from pre-tax pay, the remaining amount is the net income. This can be the amount that flows into retained earnings, after deductions for any cash or stock profits.

|

| Income Statement |

3. Statement of Cash Flows

The Statement of Cash Streams is one of the key statements that report money created and went through a particular period. Hence, compared to the pay explanation, these explanations cover a certain period, i.e., for the year finished December 31, 2017. The statement of cash flows is partitioned into three main sections:

Operating Section:

The principal revenue-generating exercises of an organization and other exercises that are not contributing or financing; are any cash streams from current resources and current liabilities.

Investing Section:

Any cash flows from the securing and transfer of long-term assets and other investments not included in cash counterparts.

Financing Section:

Any cash flows that result in changes within the estimate and composition of the contributed value and borrowings of the substance (i.e., bonds, stock, cash dividends).

|

Statement of Cash Flows |

Conclusion:

Financial statements serve as formal records passing on a company's financial well-being and performance. These reports experience investigation by government bodies, accountants, and businesses to guarantee precision and compliance. For-profit substances display adjust sheets, income statements, and cash flow statements, whereas non-profits take after a comparable structure custom-made to their setting. The adjust sheet shows a company's resources and how they're financed, balancing assets with liabilities and value. The income statement outlines revenue, expenses, and net profit, facilitating operational knowledge. The statement of cash flows tracks cash generated and spent in operating, investing, and financing exercises. Together, these financial statements give a comprehensive preview of a company's financial landscape, supporting decision-making and strategic planning.

Introduction to Accounting Standards

Introduction to Bookkeeping: Understanding the Basics

Monday, September 4, 2023

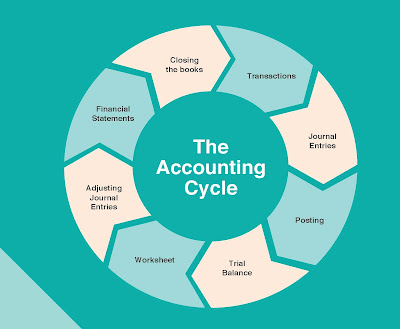

The Accounting Cycle

|

| The Accounting Cycle |

Introduction

In the world of finance and business, keeping precise and prepared records of financial transactions is vital. It ensures that a company's financial health is precisely measured and reported. In this article, we'll delve into the various steps of this cycle and explore how they contribute to effective financial management.

What is the accounting cycle?

This cycle represents a collaborative and organized approach aimed at distinguishing, comprehensively analyzing, and fastidiously recording the different ranges of accounting events that unfold inside a company's budgetary domain. This cycle starts from an exchange that transpires, capturing the very essence of financial interactions. This energetic handle coordinates a grouping of deliberate steps that unclose like chapters, each contributing to an all-encompassing account of an entity's budgetary direction. The journey encompasses intricate tasks and shrewd evaluations that come full circle in a significant minute of integration as the exchange of information finds its legitimate put inside the texture of financial articulations. It engages partners with a coherent depiction of the company's financial position but also implies the up-and-coming closing of the financial transaction through book closure. The accounting cycle develops as a fundamental budgetary compass, directing the company through a cohesive undertaking from exchange initiation to information consolidation. It guarantees monetary straightforwardness and exactness, as well as empowering educated decision-making for maintainable development and victory.

How does an accounting cycle work?

An accounts receivable or accounts payable professional, often referred to as a part of the full-cycle bookkeeping team or an accountant, undertakes the vital responsibility of meticulously recording monetary transactions. It involves not only meticulously documenting the inflow and outflow of funds, but also skillfully finalizing the books after each bookkeeping cycle. Moreover, these professionals play a crucial role in preparing comprehensive financial statements, a task that demands a firm grasp of internal control principles and a keen awareness of their role in ensuring a clear segregation of duties within the financial framework. This multifaceted role necessitates a deep understanding of financial intricacies and a commitment to maintaining the highest standards of financial integrity while facilitating the smooth and accurate portrayal of an organization's fiscal health.

Stages of the Accounting Cycle

Identify transactions:

Record exchanges in a diary:

Post transactions to the common record:

Get ready for an unadjusted trial:

Get ready to adjust entries:

Get ready for a balanced trial adjustment:

Get ready, budgetary articulations:

Near the books:

Conclusion

In a world of finance and business, fastidious record-keeping of monetary exchanges is of monstrous significance through the bookkeeping cycle, an imperative handle that serves as the bedrock for precisely gauging and communicating a company's budgetary status. At its core, this may be a systematic approach enveloping the acknowledgment, examination, and documentation of a company's financial occasions, beginning with the exchange event and coming full circle in monetary explanation integration and book closure. This coordinated arrangement leverages the ability of experts like accounts receivable/payable pros, necessarily to full-cycle bookkeeping or proficient bookkeeping groups. Their part expands to fastidiously recording money-related trades, counting inflows/outflows, and adeptly closing books post each cycle. Additionally, they bear the crucial obligation of creating comprehensive monetary articulations, requesting profound comprehension of inner controls and mindfulness of maintaining transparent duty divisions within the budgetary system. This perplexing obligation orders significant money-related understanding and unflinching commitment to maintaining the most elevated standards of integrity, empowering the exact depiction of an organization's monetary well-being and encouraging educated decision-making for sustainable development. Through eight stages, the bookkeeping cycle becomes a technique for gifted bookkeepers to capture, analyze, and pass on a company's money-related information. From distinguishing exchanges to adjusting trial accounts, planning budgetary explanations, and closing books, each step contributes to the all-encompassing representation of an entity's monetary scene. This cyclic travel brings the money-related story to life, offering stakeholders an educated see of the organization's financial direction and supporting prudent financial planning and management.

Saturday, May 13, 2023