The Accounting Cycle

|

| The Accounting Cycle |

Introduction

In the world of finance and business, keeping precise and prepared records of financial transactions is vital. It ensures that a company's financial health is precisely measured and reported. In this article, we'll delve into the various steps of this cycle and explore how they contribute to effective financial management.

What is the accounting cycle?

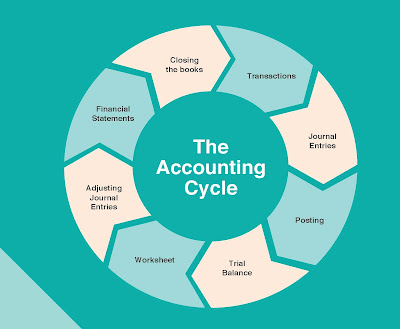

This cycle represents a collaborative and organized approach aimed at distinguishing, comprehensively analyzing, and fastidiously recording the different ranges of accounting events that unfold inside a company's budgetary domain. This cycle starts from an exchange that transpires, capturing the very essence of financial interactions. This energetic handle coordinates a grouping of deliberate steps that unclose like chapters, each contributing to an all-encompassing account of an entity's budgetary direction. The journey encompasses intricate tasks and shrewd evaluations that come full circle in a significant minute of integration as the exchange of information finds its legitimate put inside the texture of financial articulations. It engages partners with a coherent depiction of the company's financial position but also implies the up-and-coming closing of the financial transaction through book closure. The accounting cycle develops as a fundamental budgetary compass, directing the company through a cohesive undertaking from exchange initiation to information consolidation. It guarantees monetary straightforwardness and exactness, as well as empowering educated decision-making for maintainable development and victory.

How does an accounting cycle work?

An accounts receivable or accounts payable professional, often referred to as a part of the full-cycle bookkeeping team or an accountant, undertakes the vital responsibility of meticulously recording monetary transactions. It involves not only meticulously documenting the inflow and outflow of funds, but also skillfully finalizing the books after each bookkeeping cycle. Moreover, these professionals play a crucial role in preparing comprehensive financial statements, a task that demands a firm grasp of internal control principles and a keen awareness of their role in ensuring a clear segregation of duties within the financial framework. This multifaceted role necessitates a deep understanding of financial intricacies and a commitment to maintaining the highest standards of financial integrity while facilitating the smooth and accurate portrayal of an organization's fiscal health.

Stages of the Accounting Cycle

Identify transactions:

Record exchanges in a diary:

Post transactions to the common record:

Get ready for an unadjusted trial:

Get ready to adjust entries:

Get ready for a balanced trial adjustment:

Get ready, budgetary articulations:

Near the books:

Conclusion

In a world of finance and business, fastidious record-keeping of monetary exchanges is of monstrous significance through the bookkeeping cycle, an imperative handle that serves as the bedrock for precisely gauging and communicating a company's budgetary status. At its core, this may be a systematic approach enveloping the acknowledgment, examination, and documentation of a company's financial occasions, beginning with the exchange event and coming full circle in monetary explanation integration and book closure. This coordinated arrangement leverages the ability of experts like accounts receivable/payable pros, necessarily to full-cycle bookkeeping or proficient bookkeeping groups. Their part expands to fastidiously recording money-related trades, counting inflows/outflows, and adeptly closing books post each cycle. Additionally, they bear the crucial obligation of creating comprehensive monetary articulations, requesting profound comprehension of inner controls and mindfulness of maintaining transparent duty divisions within the budgetary system. This perplexing obligation orders significant money-related understanding and unflinching commitment to maintaining the most elevated standards of integrity, empowering the exact depiction of an organization's monetary well-being and encouraging educated decision-making for sustainable development. Through eight stages, the bookkeeping cycle becomes a technique for gifted bookkeepers to capture, analyze, and pass on a company's money-related information. From distinguishing exchanges to adjusting trial accounts, planning budgetary explanations, and closing books, each step contributes to the all-encompassing representation of an entity's monetary scene. This cyclic travel brings the money-related story to life, offering stakeholders an educated see of the organization's financial direction and supporting prudent financial planning and management.

No comments:

Post a Comment